Reduction in the value of an intangible asset by prorating its cost over a period of time (generally in multiple accounting periods) is called Amortization. Point worth remembering is that it can only be done for intangible assets such as copyrights, patents, trademarks, goodwill, etc. It is used for writing-off intangible assets whereas depreciation is used for tangible assets.

If related to obligations, it can also mean payment of any debt in regular instalments over a period of time. Home and other loans often talk about such amortization schedules.

If an intangible asset has an unlimited life then a yearly impairment test is done, which may result in a reduction of its book value.

Example

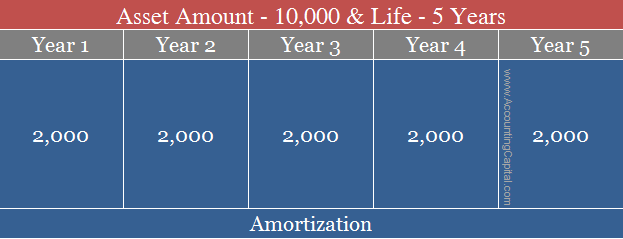

Suppose a company Unreal Pvt Ltd. develops new software and gets copyright for 10000 and it is expected to last for 5 years.

Now, if the company shows the entire 10,000 as an expense, it will not show the true and fair picture for that accounting period and the profits for that year will show deflated numbers. Hence, every year the company shall record 2,000 for 5 years to write off the copyright’s entire cost, 2,000 X 5 Years

Source: accountingcapital.com

0 Comments